Are you ready to launch your Nebraska LLC but need to confirm your perfect business name is available?

Wondering how to avoid costly rejection letters and wasted filing fees?

Curious which state tool gives you real-time insights into existing company names and their status?

To check name availability in Nebraska, visit the Secretary of State’s Business Entity Search portal, select the “Business Name” filter, enter your desired LLC name (without punctuation), and run the query. Review the results grid for exact or confusingly similar matches—active names will block your filing, while dissolved or delinquent entries offer no protection. If no conflicting records appear, you can confidently reserve the name for 120 days with a $15 fee or proceed directly to file your Certificate of Organization.

In this guide, you’ll learn:

- How to navigate the Nebraska SOS Business Entity Search tool

- Tips for interpreting status indicators and avoiding near-matches

- Steps to reserve your LLC name online and secure it for 120 days

- Best practices for documenting your name-availability check in your formation packet

Ready to lock in your brand? Let’s dive in and see exactly how to check business name availability in Nebraska!

Nebraska Business Entity Search Explained

Nebraska’s official nebraska business entity search does more than confirm whether an LLC name is free. The database doubles as a public due-diligence portal, revealing formation dates, registered-agent addresses, and dissolution history for every filing in the state. By reviewing a competitor’s status before you file, you avoid paying for paperwork that will be rejected and gain insight into how active firms structure themselves across counties and industries.

- Quickly spot duplicate or deceptively similar business names

- Download PDF images of previous filings and amendments

- Verify that a prospective supplier still enjoys good standing

- Cross-check the registered agent and physical office on record

Because the database syncs in real time with the secretary of state corporation records, the information you see is authoritative the moment it appears. Bookmark the page, rerun the search at midnight before filing, and include the printout in your formation packet to prove you exercised naming diligence.

How to Perform a Nebraska LLC Search (Step-by-Step Guide)

Before filing anything, walk through Nebraska’s free online search tool to clear conflicts, uncover dormant entities, and capture document numbers you will need for EINs and bank accounts. The five steps below take less than ten minutes yet save days of rejection delays, refund waits, and frantic phone calls to the Secretary of State.

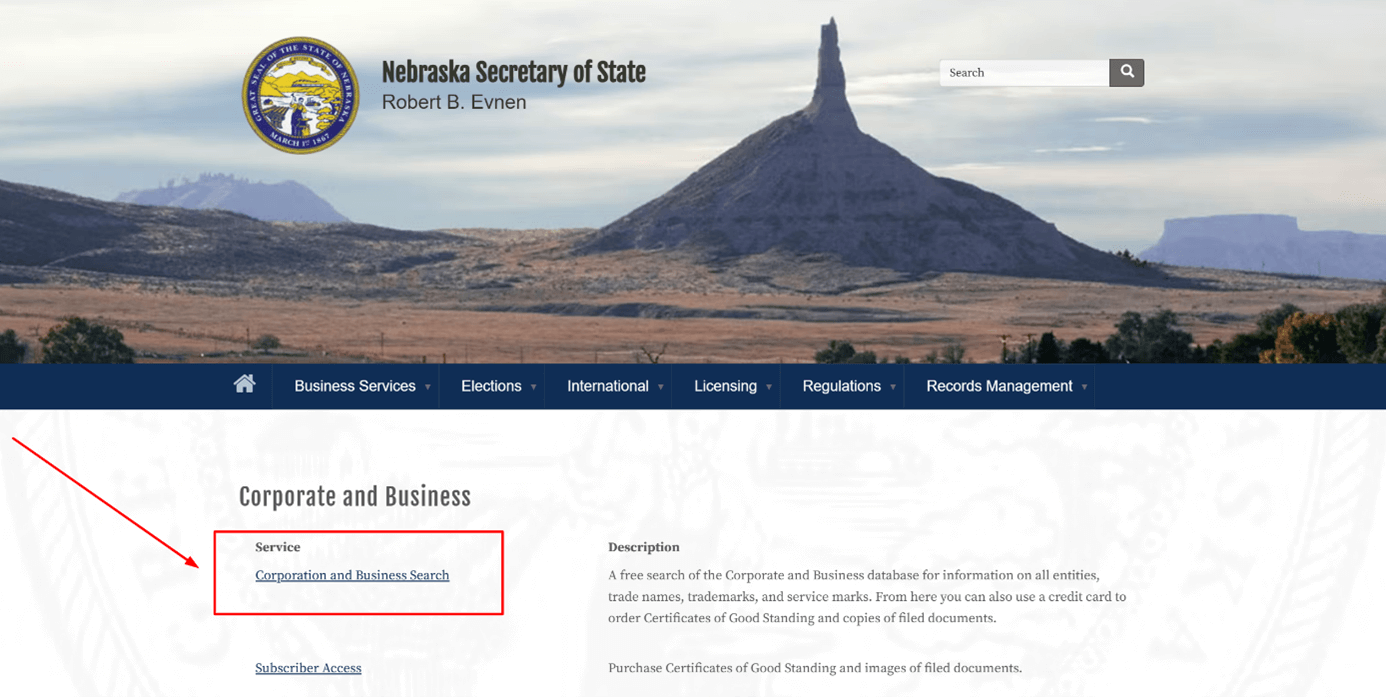

Step 1: Go to the Nebraska Secretary of State Business Search Page

Open your browser and type “Nebraska Corporate & Business Search” or navigate from SOS’ Services menu. Choose the Business Search link marked by the state seal. The landing page belongs to the nebraska secretary, so ignore sponsored ads that mimic it. Bookmark the URL for future filings; every certificate request and biennial report begins here, making the site the anchor for your compliance workflow. Curious about overall timing? Learn how long it takes to get an LLC in Nebraska from filing to certificate.

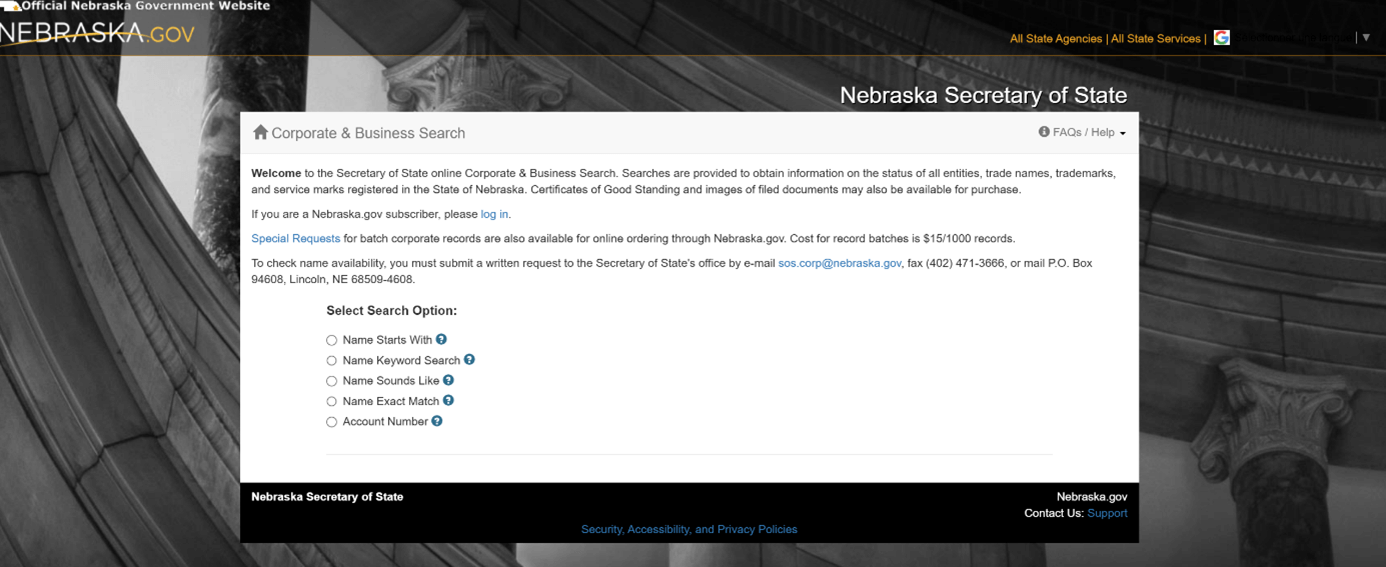

Step 2: Search by Business Name, Account Number, or Registered Agent

Start with a broad query. Enter a distinctive root word, leave off punctuation, and pick “Contains” so the engine retrieves every variation. Advanced users can filter by entity type or SOS account number to jump directly to a single record. If you know a competitor’s agent address, drop that into the Registered Agent field to surface all companies tied to that street—a quick way to gauge capacity at popular service firms and identify regional conglomerates. For tips on crafting searches that catch every conflict, see our guide on how to check LLC names.

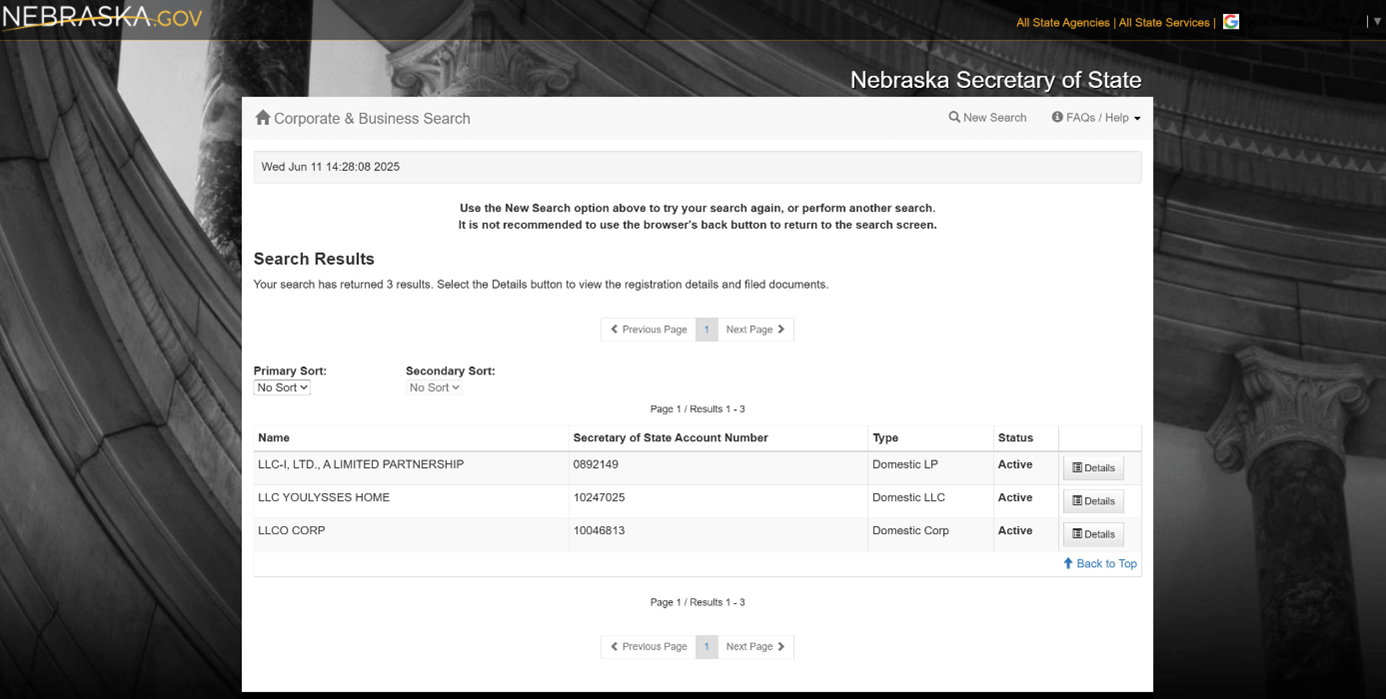

Step 3: Analyze Name Availability and Similar Entities

Review the results grid. The Status column shows whether the record is Active, Dissolved, or Delinquent. Click each entry to judge how close it comes to an exact match with your desired brand. Pay attention to plurals, abbreviations, punctuation, and spacing tricks: “Cornhusker Trucking LLC” blocks “Cornhusker Trucking & Logistics,” but “Cornhusker Trucks” may pass if ownership and NAICS codes differ significantly.

Step 4: View Business Details, Status, and Filing History

Selecting a record opens its profile page with formation date, agent, principal office, and filing images. Scroll down and open the “Filings” accordion to confirm amendments, dissolutions, or mergers. A green bar noting “Good Standing” means the company can legally transact; if it reads “Delinquent,” the Secretary will not accept a new certificate of good standing. Download each PDF now—banks require proof before funding, and investors love detailed diligence folders during Series A conversations.

Step 5: Save or Print Results for Your Filing Records

Click “Printer-Friendly Version” or use Ctrl-P to export a clean PDF. Title the file with today’s date and tuck it in your formation folder. This practice creates an audit trail proving you checked availability and took reasonable steps to avoid confusion. Many CPAs request the snapshot when onboarding new clients, so you’ll impress them with organized business services documentation and proactive record keeping.

Make Your Nebraska LLC Official, ZenBusiness Makes It Easy

From name search to filing, ZenBusiness handles the details so you can launch with clarity, speed, and confidence.

Nebraska LLC Name Availability Rules (What’s Allowed & What’s Not)

Choosing a label is not just creative work; the state applies strict filters during every llc name search. Understanding suffixes, forbidden words, and distinguishability rules upfront lets you sail through approval without expensive revisions, surprise rejection letters, or wasted advertising dollars on a brand you cannot keep. A few minutes of research now prevents weeks of costly rebranding later.

Legal Suffixes Required for Nebraska LLCs

Nebraska statute 21-108 mandates that every domestic limited liability company end with “Limited Liability Company,” “L.L.C.,” or “LLC.” Variants like “Ltd Liability Co” or “Company Limited” fail the test. While you may shorten the word “Company” to “Co,” you cannot drop “Liability,” because that term alerts the public to your liability shield. Place the suffix at the very end of the name, right after commas, ampersands, or branding tags. Foreign LLCs must keep the original jurisdictional ending unless they adopt a compliant fictitious name. To avoid printer errors, double-check that the suffix appears in the exact same font and size on every form, advertisement, and bank resolution you submit. Consistency counts in official filings.

Restricted Words You Cannot Use in Nebraska LLC Names

Certain terms require extra approval or are banned outright. When you’re ready to form your company, follow our full walkthrough on how to start an LLC. Words implying banking, insurance, or trust powers demand sign-off from state regulators. Phrases such as “Federal,” “Reserve,” “Postal Service,” or “Secret Service” are prohibited to prevent consumer confusion. Any suggestion of governmental affiliation triggers rejection. Protecting intellectual property also matters: trademarked brand names owned by others will fail instantly, even if no Nebraska entity has filed them. If your niche needs specialist wording—like “Architects”—secure board approval first. Run a quick USPTO TESS search alongside the state database to avoid conflicts that could spark a cease-and-desist letter months after launch. These safeguards apply within state lines.

Name Distinguishability Requirements Under Nebraska Law

The Secretary compares every new filing against thousands of existing records to ensure adequate separation. A name is distinguishable only if it changes a key word, reorders terms, or substitutes unique numerals. Swapping punctuation, capitalization, or filler articles like “the” and “a” is meaningless. Run every draft through the checker, then search with wildcards to confirm your final business name search clears the database. Spending five extra minutes here beats spending fifty dollars on a rejection and overnighting revised Articles. When in doubt, add a memorable adjective or industry tag that still looks professional to customers and meets the statutory test.

How to Reserve an LLC Name in Nebraska

Securing your desired brand before filing a nebraska llc keeps opportunistic rivals from grabbing it while you draft paperwork. The state lets you lock the name for 120 days with a simple online form and a modest fee, buying breathing room to finish your operating agreement, line up funding, design logos, schedule license consultations, and order preliminary marketing materials that match your final choice.

- Log in to the Corporate & Business portal and choose “Name Reservation.”

- Search again to confirm no last-minute filings slipped in overnight.

- Enter the proposed name exactly as it will appear, including the LLC suffix.

- Pay the $15 reservation fee by card or eCheck and submit the form.

- Download the confirmation PDF and note the expiration date on your calendar.

Remember, a reservation only holds the label; it doesn’t create any legal entities. If your launch timeline extends beyond four months, renew the hold or proceed straight to formation to avoid losing the name to a faster competitor.

Northwest Handles Your Nebraska LLC Without the Noise

Get your name reserved, filings submitted, and privacy protected, no spam, no gimmicks, just real service.

How to Register an LLC in Nebraska (Step-by-Step Process)

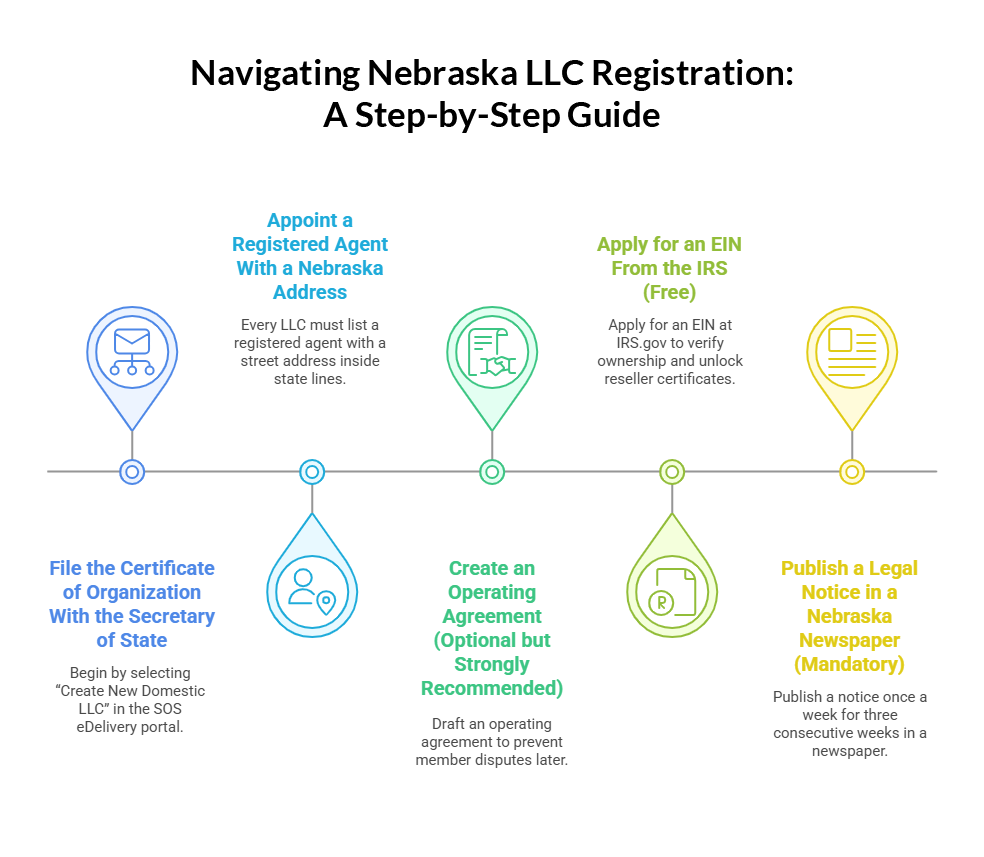

Creating an LLC with the nebraska secretary of state involves five precise filings and public steps. Follow them in order to shield personal assets, secure a bank account quickly, and satisfy state, county, and IRS requirements without back-tracking. Set aside a focused afternoon and keep all confirmations in one cloud folder to streamline future audits. Ready to take the next step? Follow our detailed guide on how to start an LLC in Nebraska and launch today.

Step 1: File the Certificate of Organization With the Secretary of State

Begin by selecting “Create New Domestic LLC” in the SOS eDelivery portal. Enter your exact entity name, including the LLC suffix, then verify availability with the inline checker. The form asks for designated office street address, nature of business, and duration (perpetual is the default). If your venture offers licensed professional services—like engineering or architecture—upload the Nebraska board approval letter at the attachment prompt. Accept electronic service of process, review for typos, and pay the $100 fee. The system emails a stamped certificate within minutes; download it. Banks and processors will demand that PDF before opening accounts, and some counties require it when applying for local tax IDs, so store multiple copies under the folder labelled business names.

Step 2: Appoint a Registered Agent With a Nebraska Address

Every LLC must list a registered agent with a street address inside state lines. Serve yourself if you seldom travel, but remember the address becomes public. Commercial agents charge about $110 per year and forward lawsuits plus certified mail digitally, preserving privacy. Provide the agent’s full name, physical address, email, and consent; mismatched ZIP codes trigger rejection. Note renewal pricing in your budget tracker so the invoice never surprises you. To compare top providers, explore the registered agent Nebraska options that fit your privacy and compliance needs.

Step 3: Create an Operating Agreement (Optional but Strongly Recommended)

Nebraska doesn’t require an operating agreement, yet drafting one prevents member disputes later. Outline ownership percentages, voting rules, capital calls, and dissociation triggers. Include succession language covering death or incapacity. Store a signed copy at the LLC’s physical address with tax files; many underwriters and equipment lessors request it before extending credit. Update the agreement whenever equity shifts and have all members initial the changes.

Step 4: Apply for an EIN From the IRS (Free)

Apply for an EIN at IRS.gov. The wizard opens daily from 7 a.m. to 10 p.m. EST and issues the number immediately with a downloadable letter. Besides payroll and tax filings, the EIN helps verify ownership on social media shopping tools and unlocks reseller certificates. Save the PDF in the same folder as your Certificate of Organization so lenders can trace filings in seconds. If you ever need to update your entity name on IRS records, see how to change EIN name smoothly.

Step 5: Publish a Legal Notice in a Nebraska Newspaper (Mandatory)

Within 45 days of formation, publish a notice once a week for three consecutive weeks in a newspaper circulating within the county that hosts your designated office. Publishers charge $50–$80 depending on column length. After the last run, the paper mails an affidavit; upload it to the SOS portal. Failure to publish can void your filing, leaving registered businesses vulnerable to administrative dissolution and forcing costly reinstatement.

Using the Nebraska Business Search Tool Like a Pro

Seasoned owners treat the SOS database like a Swiss-army knife. Mastering corporation search shortcuts lets you vet partners, monitor competitors, and maintain spotless compliance in minutes instead of hours. The quick tricks below elevate you from casual browser to power user capable of surfacing hidden insights with two clicks and zero frustration.

Search by Account Number, Entity Type, or Registered Agent

Start by selecting the Account Number filter whenever you possess the eight-digit ID from invoices or tax letters—doing so bypasses noisy keyword results and loads the record instantly. When researching service companies, choose the entered in their business agent-name filter; it reveals every entity they manage, exposing staff capacity and reputation trends. Toggle “Active Only” to hide dissolved entities, sort by creation date to spot newcomers winning market share, then export the CSV for offline pivot-table analysis.

View Entity Status, Filing Dates, Officer Names, and Standing

Inside a profile, click the Standing badge to expand filing dates, officer roster, and biennial deadlines. Red “Late” indicators flag governance risk you might otherwise miss. Open the Filing History tab and stream PDFs without leaving the page—ideal for building a diligence binder fast. Auditors crave a fresh business entity report, so download it immediately. Copy the NAICS code and compare it to SBA size standards to confirm partner eligibility for future contracts.

How to Download Official Business Records or Certificates

Need proof fast? Open the Order Document tab, select Certificate, and pay six dollars by card. The system emails a link within minutes so you can forward fresh business records to investors before lunch. Bulk-order prior amendments for a dollar each to map ownership changes over time, highlighting silent pivots in strategy that might affect vendor stability.

How to Stay Compliant With Nebraska LLC Requirements

Staying compliant goes far beyond the initial filing—Nebraska’s department of revenue and the Secretary of State both watch ongoing obligations. Build a repeat-able checklist now so renewal deadlines never sneak up and freeze credit lines. Failing to track reports or taxes can trigger late fees, liens, and even administrative dissolution that scares away lenders.

- File the biennial Business Entity Report in odd-numbered years by April 1.

- Keep a current registered agent and street address on record at all times.

- Publish amendments, mergers, or dissolutions in a county newspaper when required.

- Collect and remit 7 % state sales tax plus any local surtax on taxable receipts.

- Retain formation papers, minutes, and major contracts for at least five years.

Pair those tasks with a savings sub-account earmarked for sales and use tax so quarterly vouchers never cannibalize working capital. Calendar reminders and accounting-software alerts ensure every duty is handled long before penalties—or dissolution notices—arrive.

Help With Nebraska LLC Search or Formation

Need hands-on guidance? A seasoned registered agent service can re-run your name search, prepare filings, and hand-deliver documents to the Capitol the same day you sign. Concierge help costs more than DIY, yet it spares you hold-music purgatory and rejected forms. If you’re also considering other states, see our step-by-step guide on how to start an LLC in Washington for a comparative perspective. Prefer a hybrid route? BoostSuite’s tutorials walk you through searches, articles, and publication while outsourcing only the trickiest steps—like drafting foreign-qualification paperwork. Whichever path you choose, keep every receipt, email, and approval letter in cloud storage so banks, vendors, or regulators can retrieve proof of good standing within minutes. For hands-off setup, compare the best LLC service in Nebraska and pick the package that simplifies every step.

Nebraska LLC Search – Frequently Asked Questions

Below you’ll find rapid-fire answers to the questions founders ask most. Bookmark this section so you can cite authoritative guidance when a banker emails at 5 p.m. or a vendor hesitates to extend credit. Each bite-size clarification keeps your bank account application—or LLC filing—moving forward without costly do-overs.

How do I know if my LLC name is available in Nebraska?

Run a free search on the nebraska secretary of state portal. Use the “Contains” filter first, then switch to “Starts With” for borderline matches. Click each result to open its profile and confirm Status is Active. If the name is clear, reserve it or file at once—waiting even a day risks someone else grabbing it. Screenshot the confirmation page and store it with your draft paperwork for lender reviews.

Do I have to publish my LLC in a newspaper in Nebraska?

Yes. Nebraska’s LLC Act mandates a three-week notice in a county paper. Most founders coordinate with the chamber of commerce to locate qualifying publications and negotiate discounted legal-ad rates. Provide the company name, agent address, and formation date exactly as they appear on the stamped certificate. After the third run, upload the publisher’s affidavit to the SOS portal within 45 days.

What is the biennial report for Nebraska LLCs?

The report updates ownership, agent, and address data. File it online in odd-numbered years before April 1 and pay $13 by card. The SOS syncs the data with state tax returns, keeping revenue agencies aligned. Skip the filing and your LLC slides into delinquency, blocking loans, licenses, and contract bids until reinstatement fees are paid.

Do I need a registered agent in Nebraska?

Absolutely. Nebraska law demands a local mailing address that can accept service of process. Most owners hire a registered agent service to protect privacy and guarantee daytime signature availability. Professional agents also upload lawsuits and tax notices to a secure dashboard the same day, maximizing your response window.

Can I reserve a name before forming my LLC in Nebraska?

Yes—submit an online request and pay $15 to hold the name for 120 days. Reservation helps if you’re still weighing an LLC versus a sole proprietorship or waiting on professional-license approvals. Mark the expiration date in your calendar; renew or finish forming before the hold lapses, or risk losing the name.

Looking for an overview? See Nebraska LLC Services

Start Your Nebraska LLC with Harbor Compliance

Avoid errors, rejections, and delays. Harbor Compliance handles your filings with precision, and backs it with expert compliance support.